Do you ever think about how criminals manage to hide the illegitimate source of their funds during money laundering?

A finance expert has said that earnings replication is the method they employ in order to make what is known as ‘tainted’ money appear ‘clean.’

It is a global evil that threatens the economic and institutional systems all over the world. A big emphasis is placed on the role of regulations.

Regulations help the authorities to follow the legal ways in finance and avoid illegal money sources.

Money laundering triggers and contributes to breaking those rules and negatively impacts the system.

In this article, we will understand what is money laundering with example, and how it is done to hide illegal sources in finance.

Money Laundering Process

What is money laundering, and what is an example? It is an attempt made by people in criminal acts to disguise their unlawful profit as obtained legally.

Money laundering is a process by which money can be made to lose its source through certain channels.

This process is unsafe for the economy as it also complicates the identification of criminal operations.

Real-life examples of money laundering explain how the people involved use the banks, parties, and all systems to implement their agendas.

Bonus: Visit our website to learn more about money laundering and how it can be prevented. You will find articles written by professionals on compliance and financial safety.

Common Techniques of Money Laundering

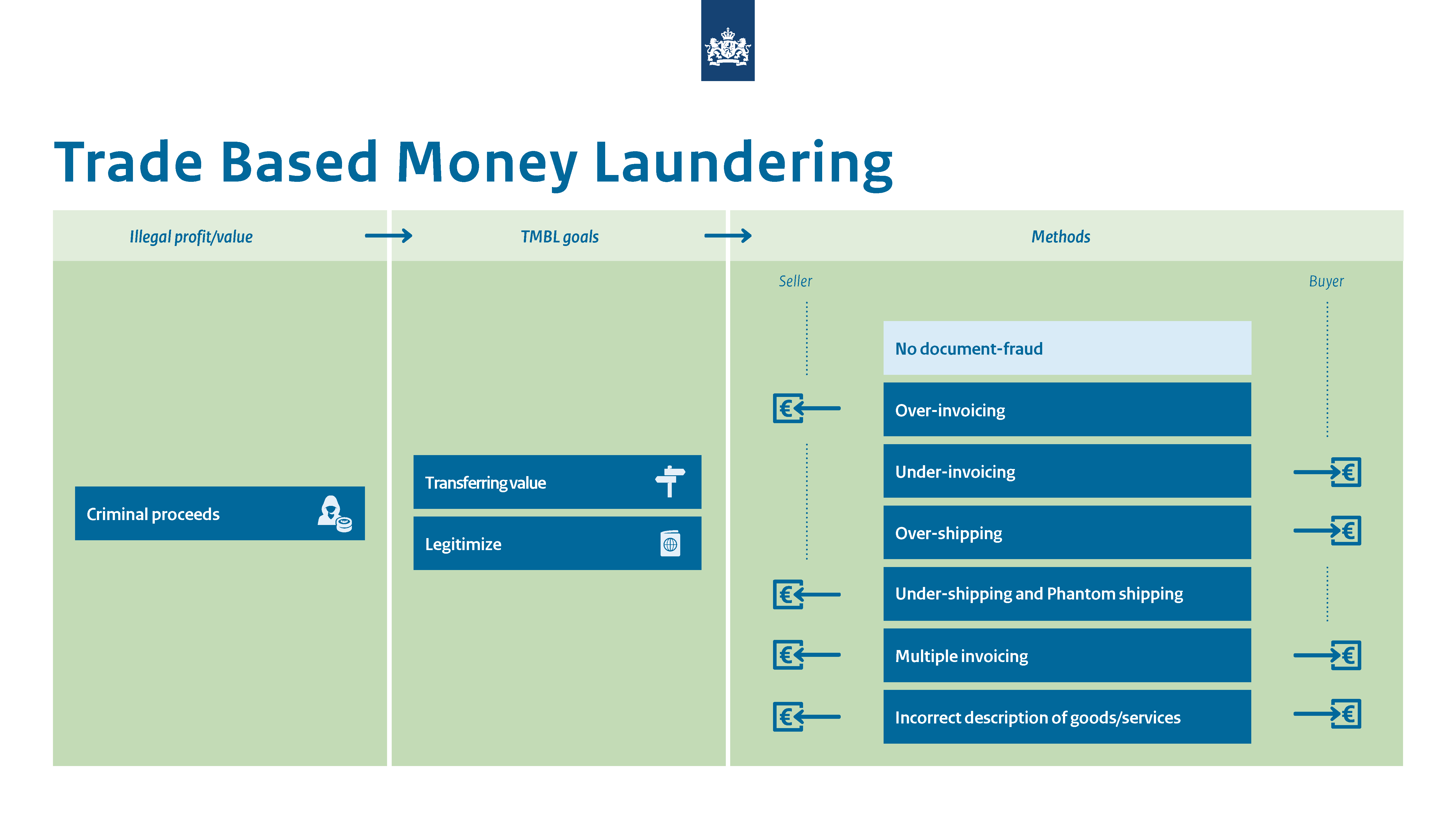

Methods of money laundering are diverse, so it is difficult to distinguish them. The known techniques encompass fake business, offshore accounts, and fake loans.

Offenders follow big schemes, such as layering or structuring transactions to conceal themselves, which is a money laundering example.

Some individuals might transfer cash through several countries just to hide the source of the money. Money laundering scheme makes it harder for authorities to catch them.

In 2024, money laundering was estimated to range between 2-5 percent of the global GDP, which is between 2.22 trillion USD and 5.54 trillion USD.

Role of Money laundering stages

In the placement stage, the money launderers introduce the proceeds of crime into the legal economy.

Then, they relocate it during layering, making it almost impossible to track a specific location during the construction.

Last is the integration phase, and the money is now clean and ready for use by different organizations.

More than $1.6 trillion is washed annually around the world, which benefits only criminal organizations.

Knowledge of such stages enables one to detect certain money laundering situations. There is a pattern to money laundering, so detecting the signs early is vital.

Money Laundering as an Element of Financial Risk

Legalization of illicit funds is the main financial threat arising from money laundering. The problem occurs when illegitimate funds are introduced into the economic flow, which negatively affects the relevant markets and undermines the public’s confidence.

The real and small businesses that people incorporate in the bank may not be aware that they are participating in money laundering.

This can lead to high penalties and fines, loss of reputation, and sometimes collapse of the firm. Money laundering techniques enable other crimes, such as terrorism and the management of drugs.

In a 2024 report, worldwide financial institutions lose billions of US dollars annually in fines for not checking money laundry. It disturbs the economy and it has a negative effect on everyone.

AML and Countering the Financing of Terrorism

Banks and some other industries have specific regulations to prevent the appearance of such money.

These rules are used to identify and deter methods of money laundering. Biometric AML is an example of legislation that imposes certain obligations upon banks, and one of them is reporting suspicious activity.

Another reason is that financial institutions have to identify their clients to prevent money laundering.

These reforms harmonize with the other measures to safeguard the system from criminal negligence in order to provide better economic security.

Recognizing Money Laundry Indications

It is difficult to recognize the signs of money laundering, but there are things one can be certain about.

For example, if a person transfers a large amount of money without any prior source of income, it may be money laundering.

Others include suspicious transactions such as fast flow to other accounts or countries. Recent research indicates that more than 300 billion in suspicious transactions are reported worldwide annually.

That is why learning what is money laundering is important as it can assist in preventing the warning signs that come with this activity before it falls into a person’s finances.

Measures to deal with money laundering

To avoid money laundering, one needs to be very cautious. Banks and other financial protection agencies need to control the flow of money and report any suspicious activity.

If strict rules are being imposed on compliance, then money laundering schemes cannot be carried out.

Staff at these institutions must also be trained on how to identify others through examples of money laundering and the appropriate action to take.

New studies also showed that in 2023, global anti-AML fines went over $1 billion, revealing the importance of escalating compliance.

Minimize the exposure of your business to money laundering risks by seeking information on compliance and business practices on our website.